GOGOS REALTY

THE GREEK

REAL ESTATE

MARKET IS

BOOMING!

HOW TO INVEST!

Thanks to foreign property buyers from Europe and other countries the investments in the Greek

real estate market increased up by 61% in 2022.

GOGOS REALTY provides a wide scale of properties, from luxury villas, holiday accommodations, homes and apartments to hotels, commercial, logistik and industrial spaces and of course land for any development needs.

What do you really need to know as an investor before you start investing in Greece and what are the benefits of investing in Greek real estate? Read the following brief but comprehensive analysis on the current situation of the Greek real estate market in order for each interested party to draw his conclusions related to the questions raised.

INTRODUCTION

The steady upward trend in the sale and rental prices of real estate, the development of tourism and the increase in the demand for real estate for short-term lease, have contributed significantly to the reduction of the depreciation time and the increase in the annual return of investment of the Greek real estates.

We are in the last quarter of the year 2023 and we see that the real estate market is fragmented and moves at different speeds depending on the category of the property, its location, its size, its age, its condition and the many other special features of each property.

FACTS

The real estate market is also affected by the general course of the economy, but at the same time we must keep in mind that a good property is a protection against inflation, while at the same time it performs much better than bank interest rates, while it can also offer capital gains.

However, the general trend over the last six years is upward, as observed by the indicators of the Bank of Greece and are shown in the table below and concern the housing market.

In this table we see that in the area of Metropolitan Athens the losses in prices that occurred during the ten-year economic crisis have now been almost fully recovered, in Thessaloniki they are very close to the levels of 2007, while in the other areas they fall by 15 to 20%.

Here, it is worth noting that some new property developments, such as the mega project of Elliniko, or the Athenian Riviera in general, have far exceeded these levels of 2007, because, among other things, they are addressed to a special and international audience.

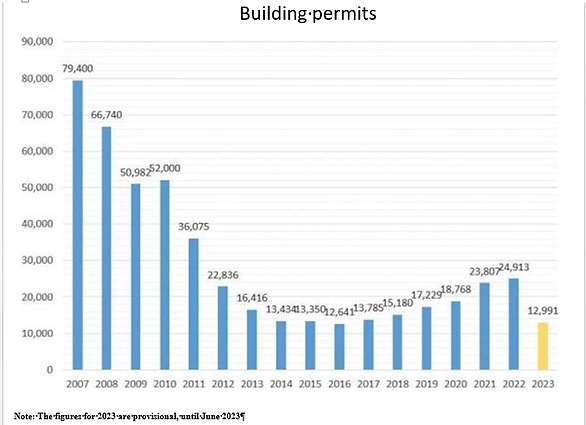

The development of building permits gives us the same picture, where since 2017 there has been an increase but at reasonable levels, as shown in the following diagram:

The Balkan environment, the ongoing war in Ukraine but after October 8 and the serious issues in Israel and Palestine, which have an impact on the Eastern Mediterranean and around the world, are risk factors whose extent and duration are not easy to determine and how they may affect the Greek real estate market.

Other factors affecting the real estate market are:

-

Energy and transportation costs

-

Cost of construction

-

The “my home” program for housing for young people aged 25 to 39

-

Shortage of workforce willing to work in this sector

-

The level of interest rates, which discourages stakeholders as unbearable

-

The demographic of the country

-

Household availabilities combined with rising cost of living

-

The short-term lease

-

The large number of closed apartments owned by banks or funds, either because their owners do not want to rent them because they may require significant amounts to be renovated. The number of apartments that have come to the public due to inheritance disclaimers and are closed is also significant.

It is also worth noting that the gradual move of the population from villages and small towns from the countryside, to the areas of Athens, Thessaloniki or cities that have many students and tourism and the search for housing has led to:

-

Increasing prices and rents in demand areas

-

Relative price stagnation in areas with depopulation, lack of industries and other productive activities

SERVICED APARTMENTS

Serviced apartments are a modern product that meets the demand. The new regulations in the short-term rental market will affect the rental landscape, but they should be balanced so as not to destroy this product, which was created in the years of the crisis, gave employment to many unemployed and did not ask for or receive subsidies both for the renovation and equipment of real estate, and during the period of COVID 19.

"GOLDEN VISA"

The properties purchased with the “golden visa” program have also played an important role, especially in the area of Attica and for investors manly from China. Already with the changes made to the minimum value of the property, we believe that part of the future buyers will turn to properties that have a lower limit of €250,000. It is noted that the changes made concern the urban agglomerations of the Municipalities of Athens and Thessaloniki, as the lower limit was increased to €500,000 for the acquisition of the “golden visa”.

"CRISIS INVESTORS"

The Israelis who have bought many properties in our country, mainly for investment purposes, now due to the war in their region, it is not certain whether and to what extent they will continue to do so, due to the imponderable factors of this crisis. At the same time, there was a demand for short-term rentals from Israelis who sent their families here for the duration of the war. This is currently an imponderable factor, whose development needs to be monitored.

MODERNIZATION

An important factor affecting the real estate sector is the upgrading and modernization of old buildings. That is for many who do not have the ability to buy a new apartment, they buy at a much lower price an old one, which they modernize and give it a new life. This solution is also compatible with environmental standards.

The demand for high-standard offices remains strong while it is limited to low-standard old office buildings.

LOGISTICS AND HOTELS

Serious interest still exists in the field of logistics and hotels, where many transactions and developments take place, while many others are in progress. These two real estate sectors are constantly on the radar of REICs (real estate portfolio companies) and other investors. However, the number of hotels in Attica should be weighted by hoteliers in order to protect them from the reduction in the occupancy of the existing hotel units.

Especially logistics properties with big heights in the building facilities and located in topical locations of the country and with "green" features, are in particularly high demand.

HOLIDAY HOMES AND LUXURY PROPERTIES

The holiday home is the subject of demand from foreign buyers and to a much lesser extent from the Greek public. We observe that the saturation in Mykonos and Santorini, and the high price levels there, have turned buyers – investors to our other beautiful islands in the Aegean and the Ionian as well as similar beautiful locations at the mainland.

Moreover, luxury properties (villas, etc.) in international destinations (Cyclades, Corfu, Crete, Rhodes, Attica coastal front, etc.) meet satisfactory demand and record prices have been recorded in some cases.

However, there is still a serious need in these areas to improve transport infrastructure and health services.

CONCLUSION

In conclusion, 2023 is very satisfactory for the real estate market but we must all be vigilant for the future, due to the many unpredictable factors mentioned earlier, especially for more expensive real estate.

Placing capital in selected properties can be a smart precaution against inflation, but also for a yield well above bank rates. Tourism is a Greek constant with very good prospects, but we must constantly monitor developments,

improve, extend the season, develop more cruise, religious tourism, spa and tourism or second home for pensioners. Our infrastructure (roads, airports, ports, hospitals and health centers, cleanliness, etc.) must be constantly improved because this will make our Greece a more attractive destination. Finally, a special mention to the final definitive solution is expected to be given to the issue of seaplanes, a very important infrastructure.

GET OUR GREEK REAL ESTATE MARKET INSIDER REPORT

FOR FREE

Our market report booklet provides a comprehensive synopsis on the Greek real estate market, including valuable insights into procedures, taxation, commonly asked questions, as well as a summary of Greeces' Central Bank Report.

Whether you're a seasoned investor or new to the market, our report is an essential tool to help you make informed decisions and optimize your returns.

Sign in to our newsletter and get your copy for free now!

VISIT THE LINKS

“Greece Residential Real Estate Market Analysis 2023” by GLOBAL PROPERTY GUIDE, January 19, 2023

https://www.globalpropertyguide.com/Europe/Greece/Price-History

Residential and commercial property price indices and other short-term indices by BANK of GREECE

Economic forecast for Greece by European Commission, November 11, 2022

Hines 2023 Global Outlook: Disruption Brings Real Estate Opportunities by HINES, January 10, 2023

https://www.hines.com/news/hines-2023-global-outlook-disruption-brings-real-estate-opportunities

SEE OUR DEVELOPMENT PROJECTS

Kosmima Porto Karras Estate is located at a exquisite eagle nest location with a astonishing view to the Grant ResortPorto Karras, the see and the sunset. Situated in a plot of 8.188,58sqm on a hilltop amidst lush olive trees and just 800m away from a 1.5km sandy beach and the city of Neos Marmaras, these holiday homes offer a spectacular peace of mind living experience, guaranteed for life.

Kosmima Porto Karras Estate is a collection of 14 holiday homes for freehold ownership within a high aesthetic and functional designed complex, at the prime sustainable destination.

Kosmima Sani Estate is located at an exquisite location.

Situated on a flatland of 32.000sqm amidst lush pine and cypress trees andjust 800m away from a 2.5km sandy beach and thehigh end Sani Resort market, these holiday homes offera spectacular peace of mind living experience, guaranteedfor life.

Kosmima Sani Estate is a collection of 64 holiday homes for freehold ownership within a high aesthetic and functional designed complex, at the prime sustainable destination.